I think taxes are one of those train wrecks, if you can avoid looking, you will be a happier person for it. I had a lovely tradition of being an adult for one day a year on April 14th by using whatever 1040 filler-outer form was in vogue that year, and calling it good. That tradition lasted a marvelous 23 years.

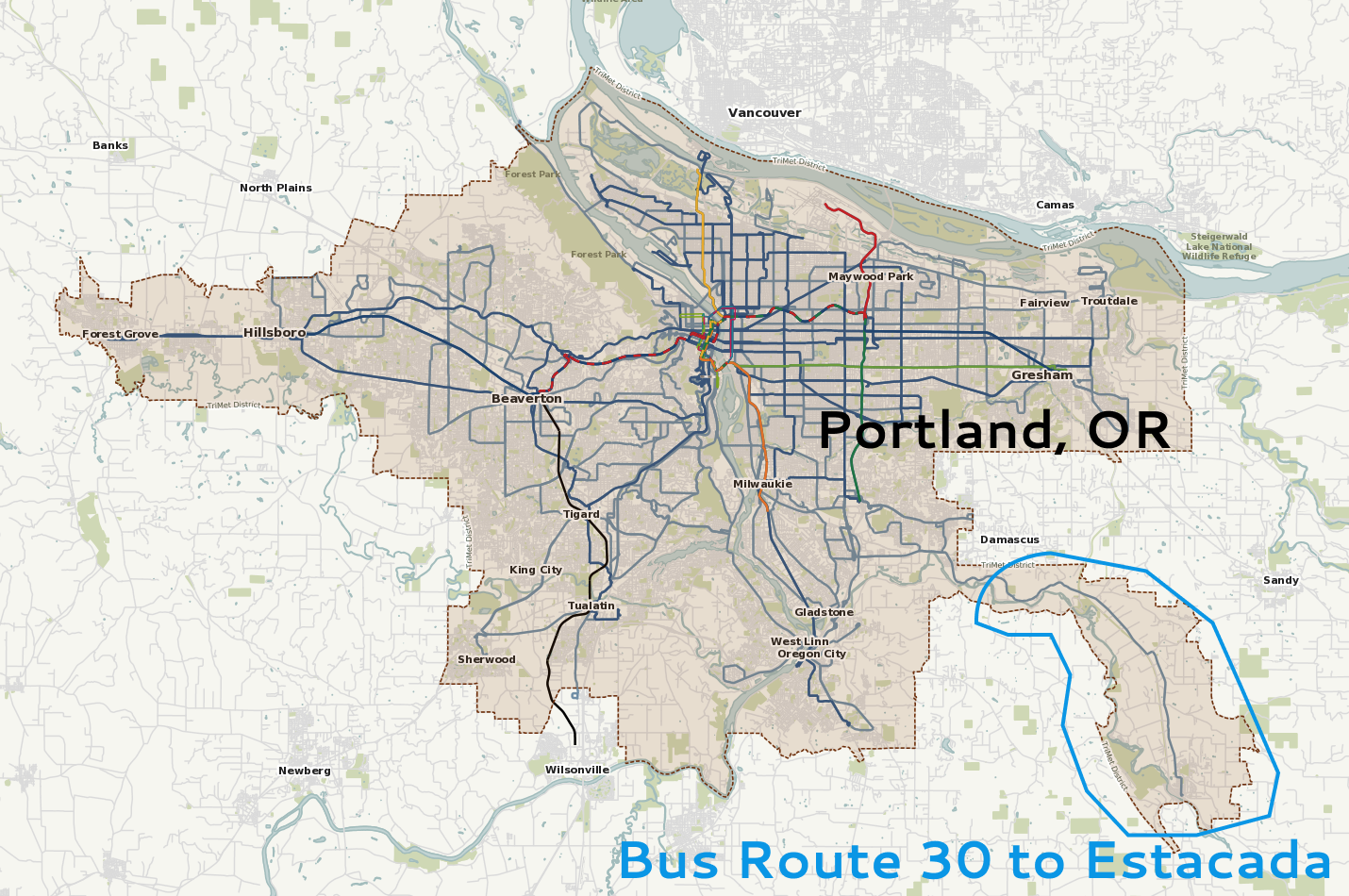

Well if I have to look, I'm going to look, especially including where the sun don't shine. There are over 4k local tax codes not linked to a state, zip, or clear municipal boundaries. My favorite tax code, follows a bus route.

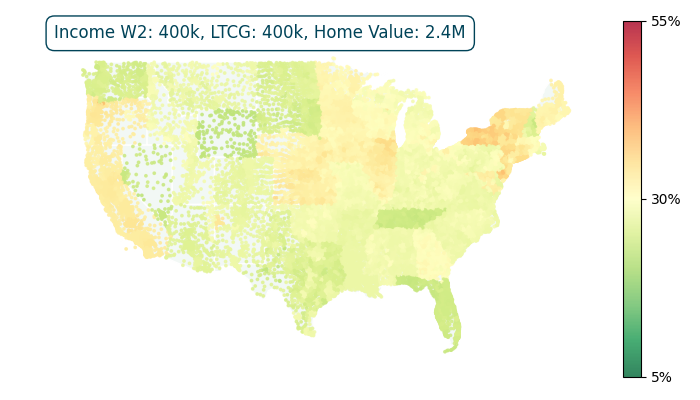

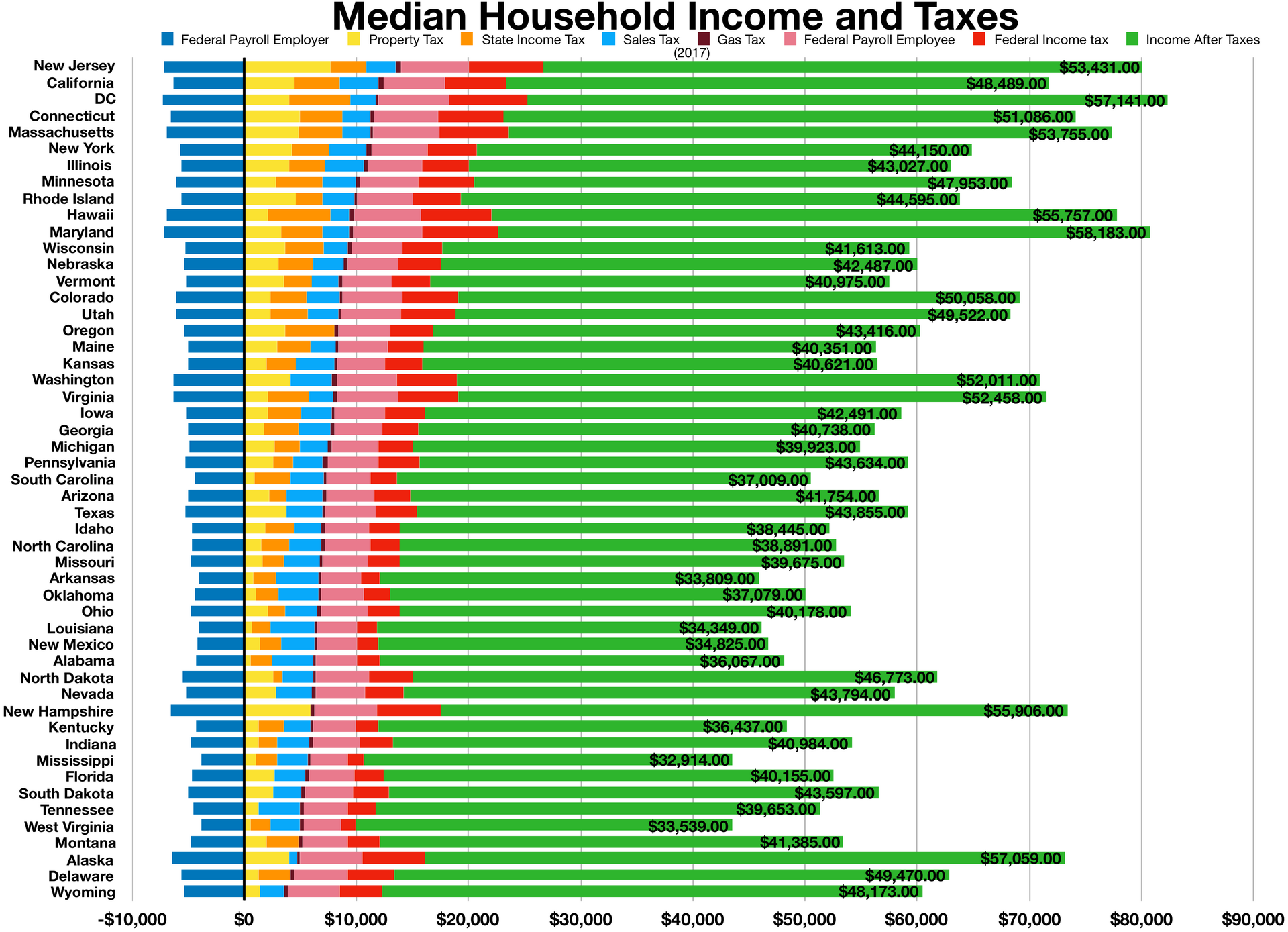

For this version of total tax estimation, I did not code up the bus route. I did code up over 200 tax codes though. The goal is to get within 1% accuracy, and for the most part this gets very close. Taxes included are Federal (with social security, medicare, and NIIT), state, county, sales tax (at the state level), and a few local taxes. Property tax rates are estimated based on median property taxes paid and median sales prices (thank you Redfin). While a crude technique for estimating property taxes, it's surprisingly accurate and helps get the total tax accuracy to within 1%. The highest property tax rate really is 3.3% in Camden New Jersey.

With no sarcasm, if you'd like to look at delightfully clear and balanced tax codes I would recommend the 1984-1990 tax reform push of New Zealand - that was sheer brilliance and determination.

One last disclaimer - these results are written following the letter of the law, and don't take into account many loopholes used at the upper income brackets. For example on property taxes, to get a $14M house in many regions you would have to build it. In many regions, the assessed value for property taxes is based on the last sale ... which for a custom build would be the land sale and wouldn't take into account the Carrara marble bathroom value. That's the tip of the iceberg for what tax and wealth advisors can come up with. I'm not as clever as they are. This is written as if you filled out a 1040ez each year.

Taking taxes into account when deciding where to live is a prudent financial strategy. Taxes can significantly affect your overall cost of living and savings potential. Here are several tax-related factors to consider:

1. State Income TaxSome states have no income tax, while others have high income tax rates. Living in a state with no or low income tax can significantly reduce your annual tax burden.

2. Sales TaxSales tax rates vary by state and even by locality within states. A higher sales tax can increase your daily living expenses, especially if you spend a lot on taxable goods and services.

3. Property TaxIf you plan to buy a home, consider the property tax rates in the area. Property taxes can vary widely and have a substantial impact on your monthly and annual housing costs.

4. Estate and Inheritance TaxesWhile not immediately relevant to everyone, the presence or absence of estate and inheritance taxes can affect long-term financial planning, especially for those with significant assets.

Making an informed decision involves weighing these tax considerations against other factors like job opportunities, lifestyle preferences, family considerations, and overall cost of living. It's also a good idea to consult with a financial planner or tax advisor to understand the nuances of tax laws in different areas and how they align with your personal and financial situation.